This video we'll be going over IRS form 1098-c this is the tax form that you would receive as a donor if you contributed a motor vehicle a boat or an airplane to charity and then this is the tax form that's completed by the dhoni to affirm the amount of the contribution for the taxpayer that made the donation so in this video we'll kind of go through some of the instructions for both donors when it comes to reporting the contributions but then also some of the instructions for the Donis that they have to follow that way donors can kind of understand a little bit of the perspective that goes behind this tax form and why certain things are required for taxpayers to be able to claim a deduction for a charitable contribution of said vehicle so you'll forgive me if I flip flop back and forth during this form I will kind of take a moment to point out a couple of things as I see them so this is the form as it appears on the IRS website there are three copies of this form I'll scroll through them really briefly and then we'll come back to the top since they're all the same so copy a is the form that gets filed with form 1096 for the Internal Revenue Service Center or for your tax return basically the um copy B actually is for the donor in order to claim a deduction of more than five hundred dollars for the specific contribution this version of the form must be attached to the donors federal tax return so one important note here is when we get to box 5A and 5B those are certifications made by the charitable organization that unless they make those certifications...

PDF editing your way

Complete or edit your amazon anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export how to fill out a 1098 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your instructions on 2020 form 1098 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your instructions for form 1098 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 1098 Instructions

About Form 1098 Instructions

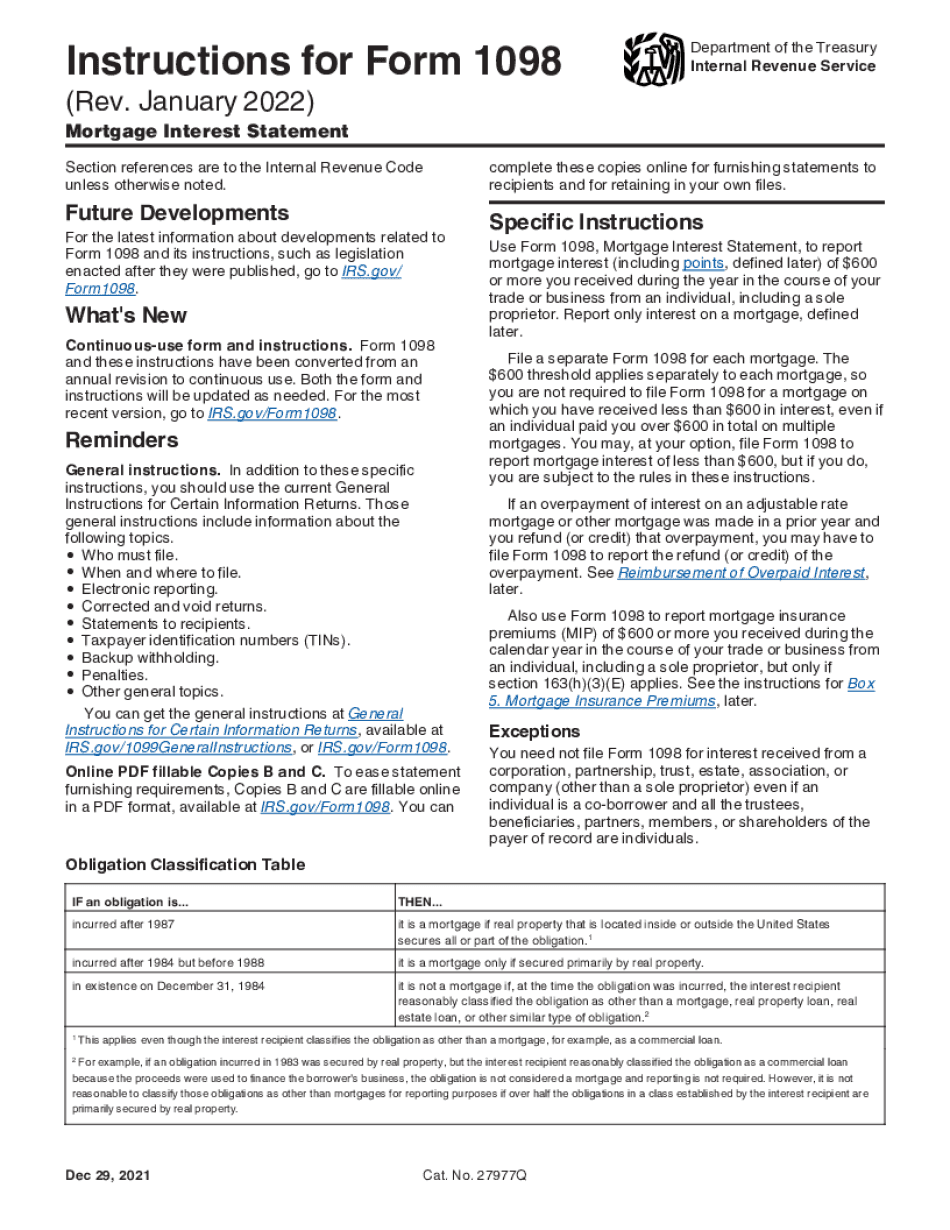

Form 1098 Instructions refer to the guidelines provided by the Internal Revenue Service (IRS) for completing Form 1098, Mortgage Interest Statement. This form is used by payers, typically financial institutions, to report mortgage interest of $600 or more received by the recipient taxpayer during the tax year. The instructions outline the information required, the steps for completion, and the proper reporting rules for Form 1098. The form provides details such as the recipient's name, address, and Social Security Number or Taxpayer Identification Number. It also includes the amount of mortgage interest received, any points paid by the taxpayer, and the address of the property securing the mortgage. These instructions are essential for financial institutions and other payers who need to report mortgage interest payments accurately to comply with the IRS regulations. Recipient taxpayers also refer to these instructions to understand the proper reporting of their mortgage interest on their individual tax returns. Overall, the Form 1098 Instructions are a crucial resource for entities responsible for reporting mortgage interest payments and for individuals who need to accurately report their mortgage interest expenses for tax purposes.

What Is amazon?

Online solutions help you to arrange your file management and strengthen the efficiency of your workflow. Look through the brief manual to be able to fill out Amazon?, avoid errors and furnish it in a timely way:

How to fill out a 2024 Irs Form 1098 Fillable?

-

On the website with the document, press Start Now and move for the editor.

-

Use the clues to fill out the suitable fields.

-

Include your personal data and contact details.

-

Make absolutely sure you enter suitable data and numbers in suitable fields.

-

Carefully examine the content in the document as well as grammar and spelling.

-

Refer to Help section in case you have any issues or address our Support staff.

-

Put an digital signature on the Amazon? printable using the support of Sign Tool.

-

Once the form is finished, click Done.

-

Distribute the prepared blank by means of electronic mail or fax, print it out or download on your device.

PDF editor enables you to make modifications on your Amazon? Fill Online from any internet linked device, personalize it according to your needs, sign it electronically and distribute in several ways.

What people say about us

Become independent with digital forms

Video instructions and help with filling out and completing Form 1098 Instructions